Summary of Fundraising

The Penn State IFC/Panhellenic Dance Marathon strives to maintain its transparency to the public.

Because THON is a completely student-run organization, it has a unique ability to maximize

each donation, ensuring that no child ever gets denied cancer treatment because the family

cannot afford it. With THON’s donations, Four Diamonds at Penn State Health Children’s Hospital can

provide each family with access to superior care, comprehensive support, and innovative cancer

research.

The 2020 SoFA could not be completed due to some issues resulting from the COVID-19 pandemic.

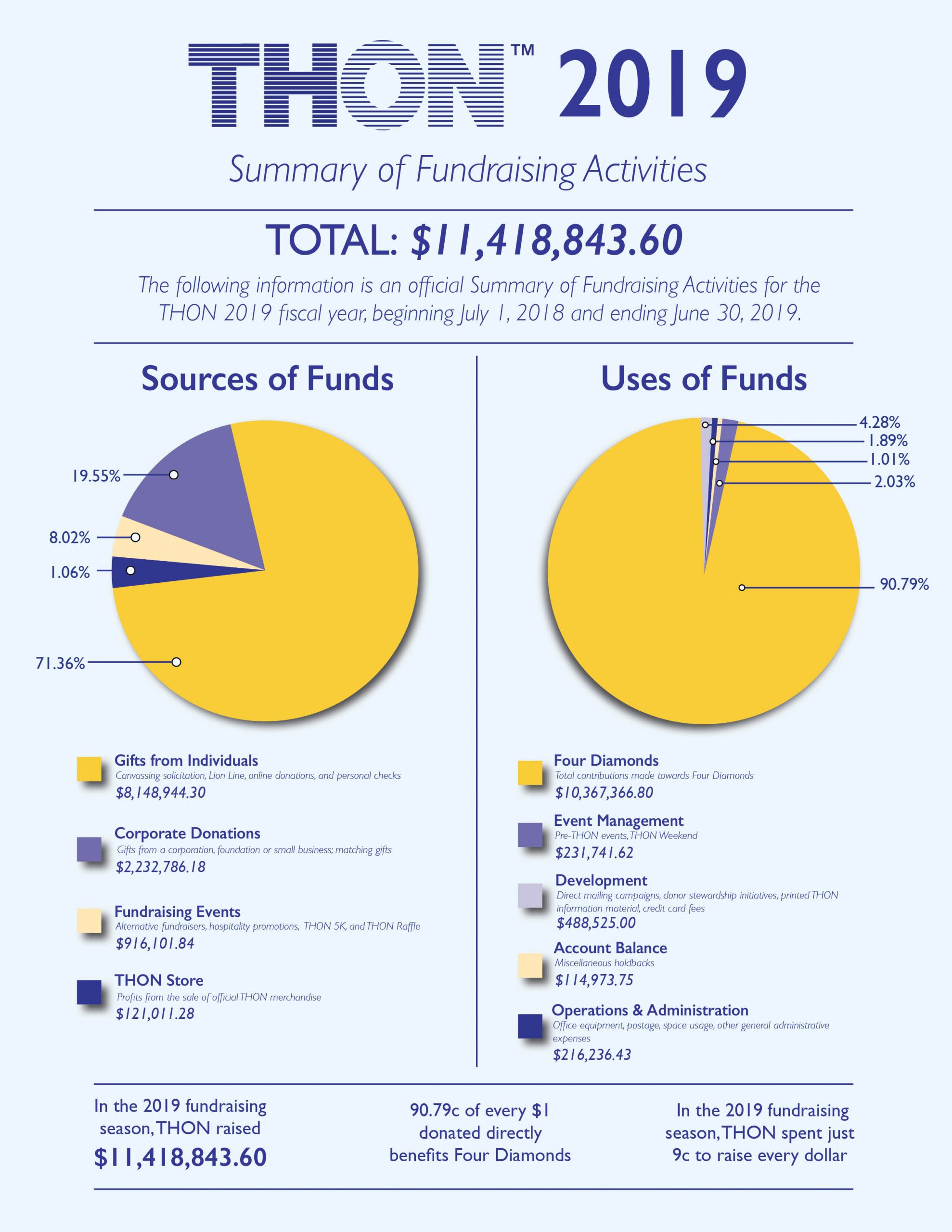

Two notable aspects of this Summary of Fundraising Activities:

90.79% Charitable Commitment: The total contributions to Four Diamonds, which exceeded $10.36 million in 2019.

91% Fundraising Efficiency: The percentage of private donations remaining after the event management, development and operations expenses to receive them. In 2019, less than 9 cents were spent to raise every dollar.

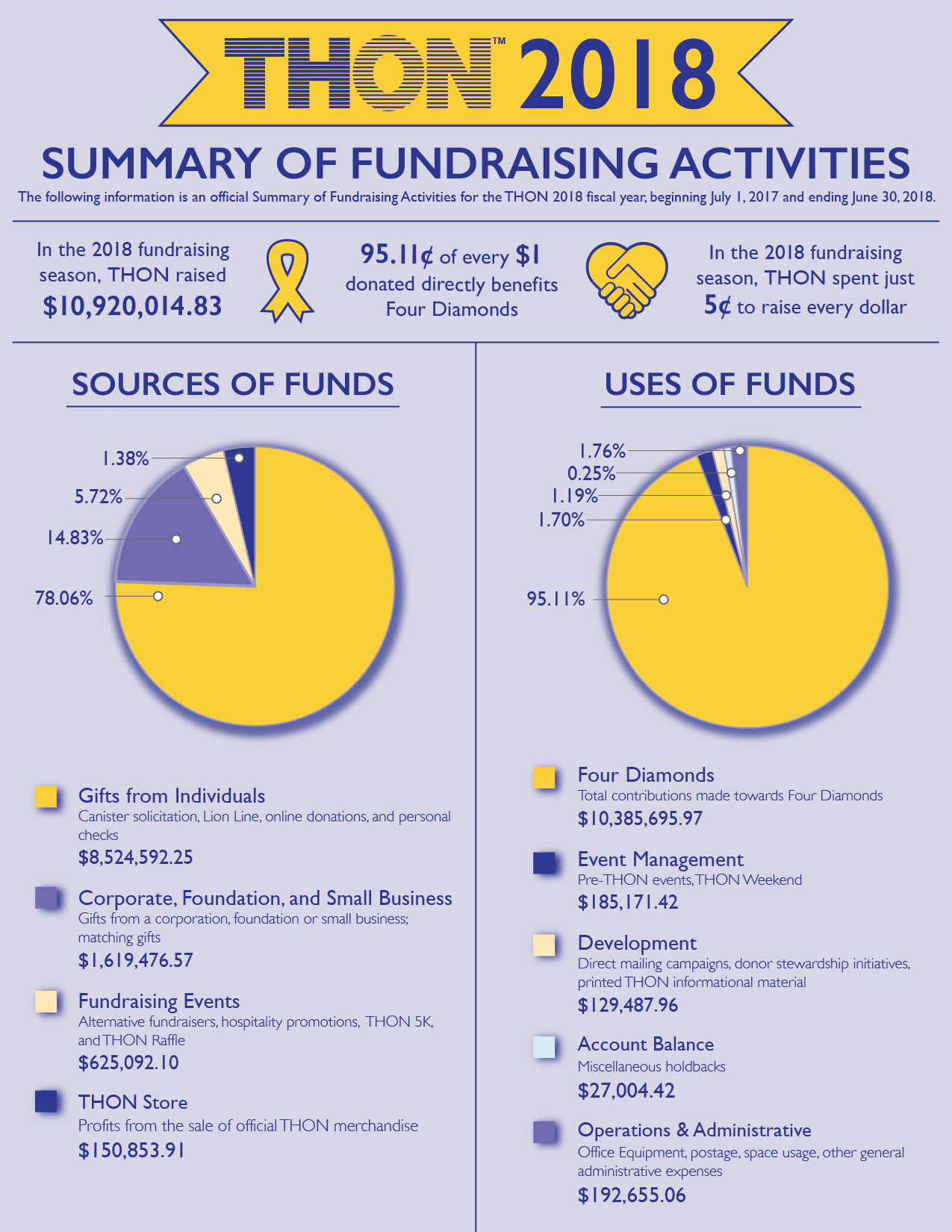

Two notable aspects of this Summary of Fundraising Activities:

95.11% Charitable Commitment: The total contributions to Four Diamonds, which exceeded $10.38 million in 2018.

95% Fundraising Efficiency: The percentage of private donations remaining after the event management, development and operations expenses to receive them. In 2018, less than 5.5 cents were spent to raise every dollar.

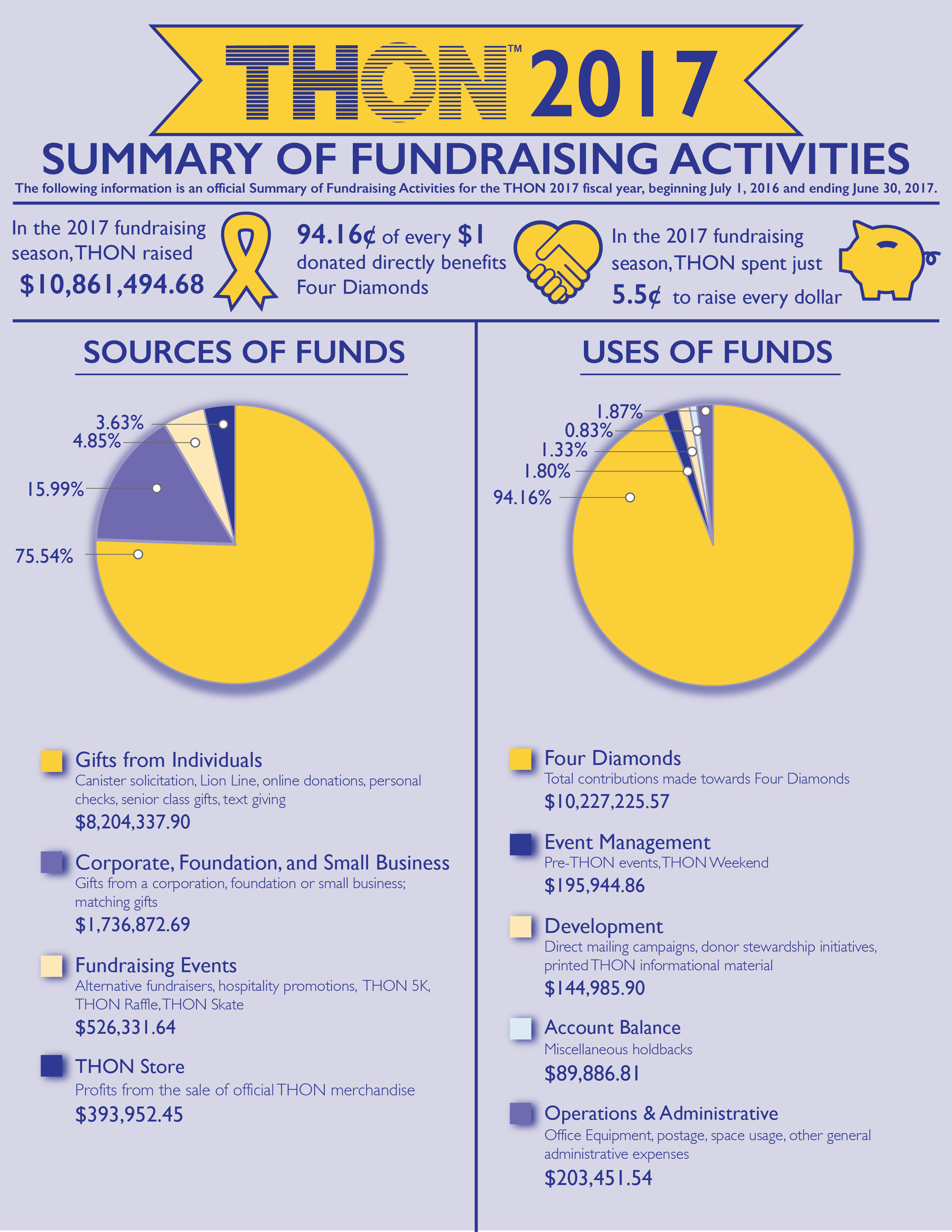

Two notable aspects of this Summary of Fundraising Activities:

94.16% Charitable Commitment: The total contributions to Four Diamonds, which exceeded $10.2 million in 2017.

94.5% Fundraising Efficiency: The percentage of private donations remaining after the event management, development and operations expenses to receive them. In 2017, less than 6 cents were spent to raise every dollar.

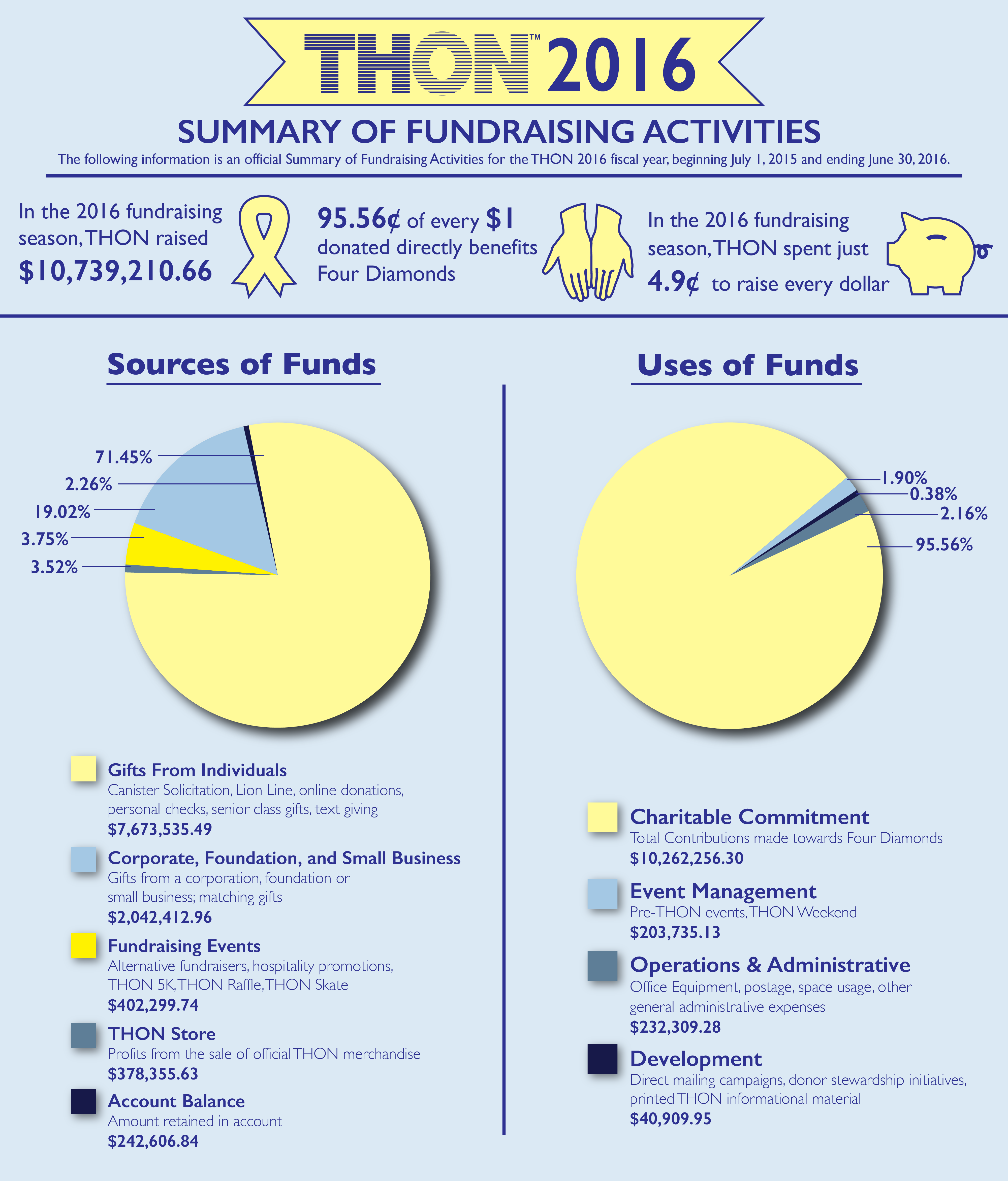

Two notable aspects of this Summary of Fundraising Activities:

95.56% Charitable Commitment: The total contributions to Four Diamonds, which exceeded $10.7 million in 2016.

95.1% Fundraising Efficiency: The percentage of private donations remaining after the event management, development and operations expenses to receive them. In 2016, less than 5 cents were spent to raise every dollar.

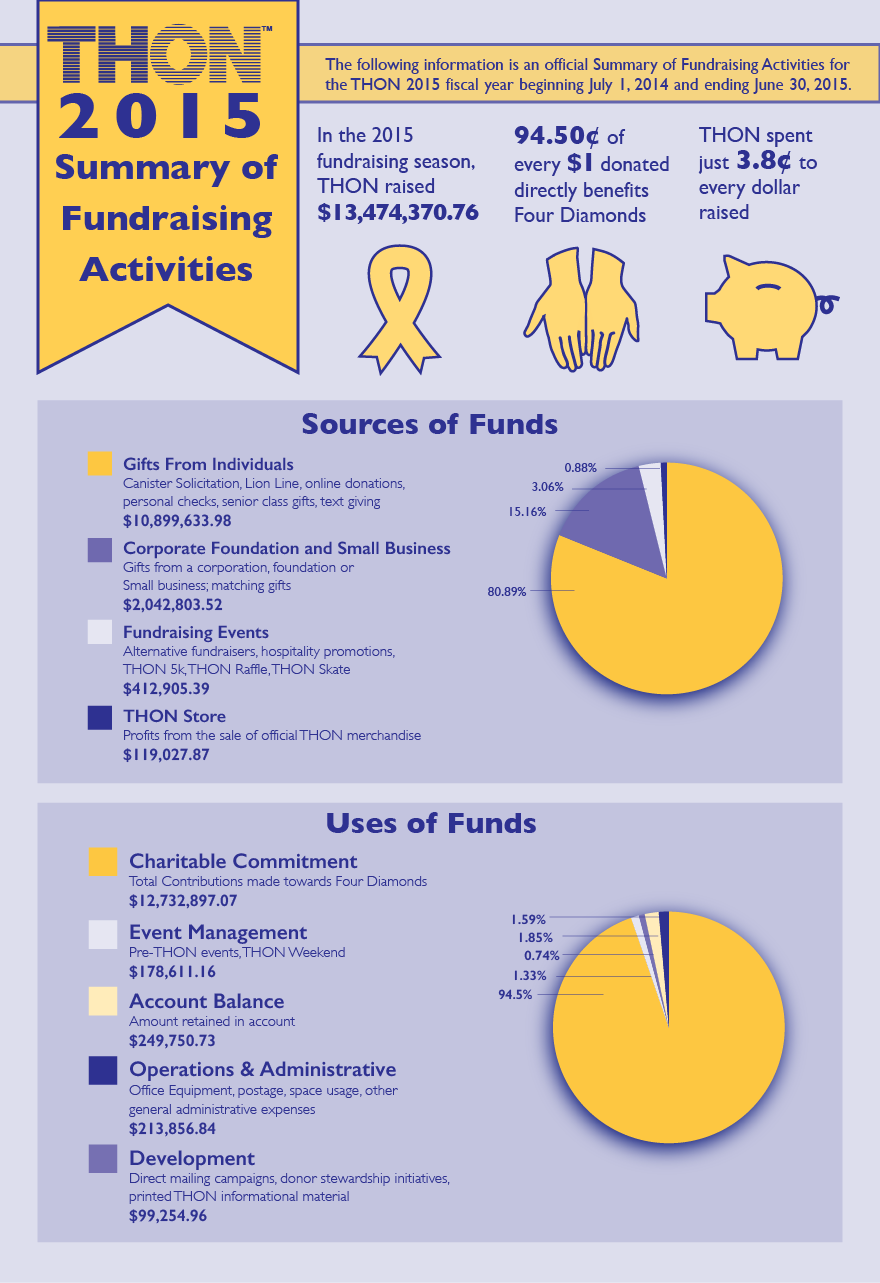

The following information contains the official Summary of Fundraising Activities for the THON 2015 fiscal year, from July 1, 2014 to June 30, 2015. All donations to the Penn State Dance Marathon are tax deductible. Our federal tax ID Number is 24-6000-376. Donations are processed by the Penn State Office of University Development and will be receipted by the University.

Two notable aspects of this Summary of Fundraising Activities:

94.5% Charitable Commitment: The total contributions to Four Diamonds, which exceeded $12.7 million in 2015.

96.2% Fundraising Efficiency: The percentage of private donations remaining after the event management, development and operations expenses to receive them. In 2015, less than 4 cents were spent to raise every dollar.

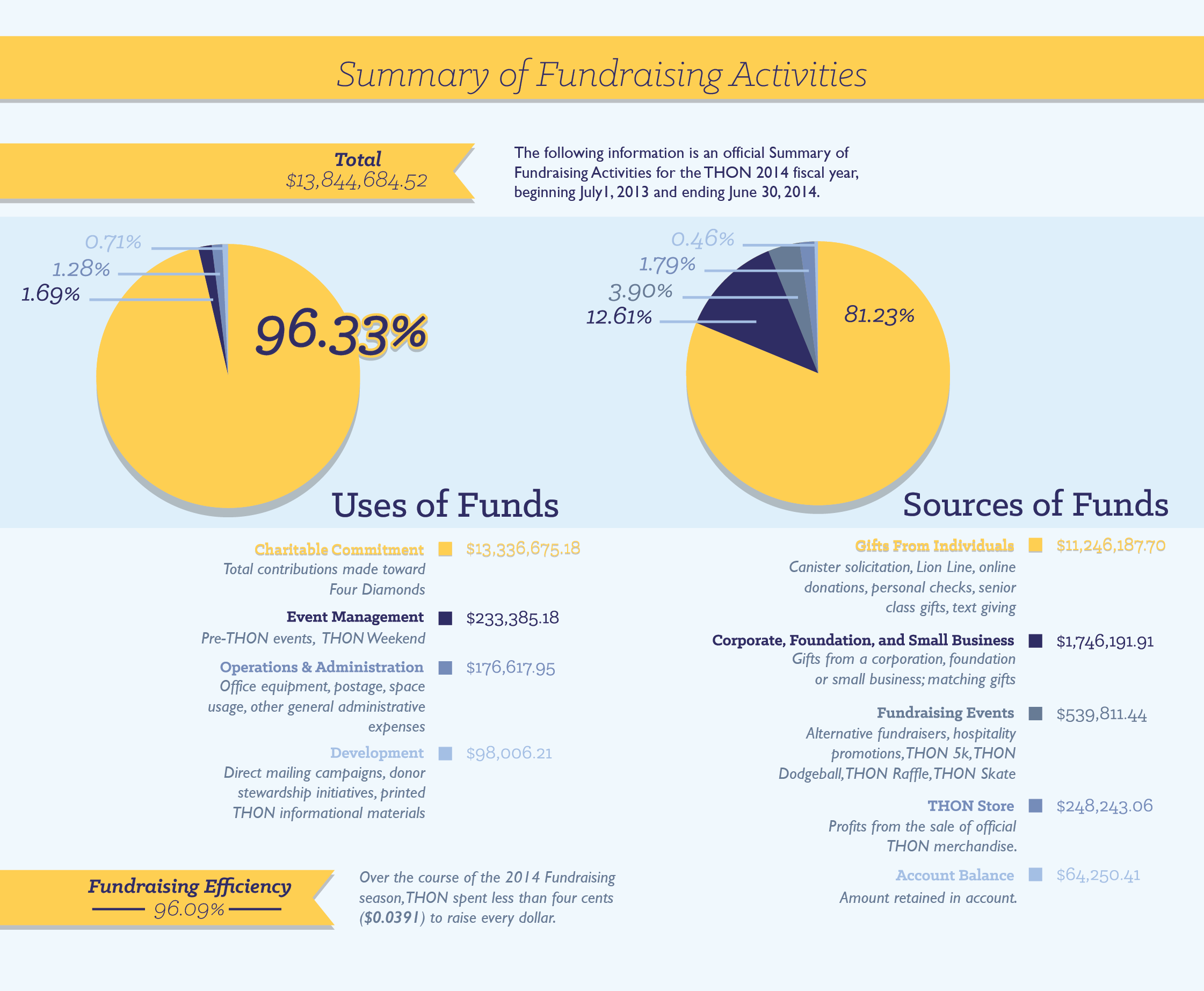

The following information contains the official Summary of Fundraising Activities for the THON 2014 fiscal year, from July 1, 2013 to June 30, 2014. All donations to the Penn State Dance Marathon are tax deductible. Our federal tax ID Number is 24-6000-376. Donations are processed by the Penn State Office of University Development and will be receipted by the University.

Two notable aspects of this Summary of Fundraising Activities:

99.33% Charitable Commitment: The total contributions to Four Diamonds, which exceeded $13.33 million in 2014.

96.09% Fundraising Efficiency: The percentage of private donations remaining after the event management, development and operations expenses to receive them. Last year, less than 4 cents were spent to raise every dollar.